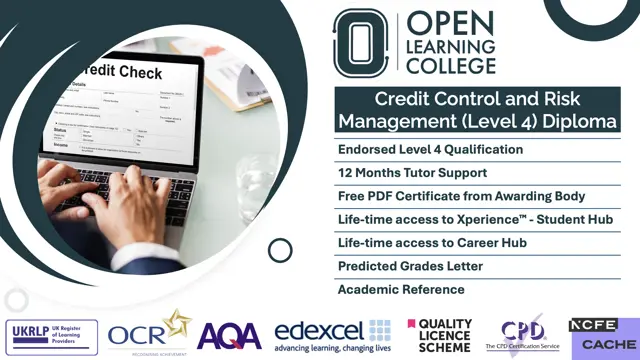

Credit Control and Risk Management (Level 4) Diploma

Distance Learning Course, featuring tutor support and AI assistance, available online or as a study pack option.

Open Learning College

Summary

Funding options available on our website

- QLS & OPA - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

- TOTUM card included in price What's this?

Add to basket or enquire

Overview

Embark on a transformative learning journey with the UK’s most innovative home study provider, offering courses designed to unlock your true potential and facilitate the career change you desire. Access our distance learning courses directly from anywhere, anytime, and acquire industry-recognised Professional Qualifications essential for advancing in your career.

Specifically, explore the flexible and convenient Credit Control and Risk Management Level 4 course, an ideal way to gain a diploma qualification. Whether you aim for further education, improved job prospects, or expanded knowledge, this comprehensive course allows you to prepare thoroughly for exams or careers through home study. Plus, it’s structured to be accessible and beneficial even if you have no prior knowledge in Credit Control and Risk Management.

The Credit Control and Risk Management course is a comprehensive exploration of advanced financial practices tailored for professionals seeking expertise in credit control and risk assessment. This course provides a deep understanding of credit management principles, risk evaluation methodologies, and strategic financial decision-making. Participants delve into analysing financial statements, assessing creditworthiness, and developing effective credit policies. The curriculum covers risk mitigation strategies, empowering individuals to identify, evaluate, and manage financial risks within diverse organisational settings. Additionally, learners explore compliance requirements and regulatory frameworks relevant to robust credit control and risk management, enhancing their proficiency in this critical aspect of financial stewardship.

Achievement

Course media

Resources

- Credit Control and Risk Management Level 4 (QLS) Course -

Description

Course Key Topics

the Credit Control and Risk Management (Level 4) course is divided into 6 modules.

Module 1: Introduction to debt

- When is debt a problem?

- Causes of personal and business debts

- Individual personal circumstances that can lead to debt

- Economic factors that can lead to debt

- Circumstances that can lead to business debt

- Other factors that can lead to debt

- Types of borrowing

- Creditor’s rights

- Non-court actions available to creditors

- Collecting debt through the court

- Enforcing the Judgement

- How long can a creditor pursue a debt for?

Module 2: Consumer credit

- What is customer credit?

- Benefits of offering customer credit

- Risks of offering customer credit

- Common regulated consumer credit activities

- Acquiring consumer credit authorisation from the Financial Conduct Authority (FCA)

- Preparing an application for FCA authorisation

- FCA rules that must be followed

- Business to Business Lending Regulation UK

- The business’s credit policy

- Customer credit agreement

Module 3: Credit risk analysis

- What is credit risk?

- Types of credit risk

- What is credit risk analysis?

- Types of information used when analysing credit risk

- Methods used to analyse credit risk

- Checking an individual customer’s likely ability to pay back debt

- Credit reference agencies

- Credit reports

- Credit check results

- How credit scores are used

- FICO Scores

- Checking a business customer’s likely ability to pay back debt

- Doing more research

- Obtaining bank references

- Contacting other suppliers

- Asking for supplier references

- Adopting the pro-forma approach

- Checking published accounts

- Obtaining a credit report from a credit bureau

- The “5 cs of credit.

- What to look out for when credit checking business customers

- Credit risk modelling

- Types of credit risk models

- Mitigating credit risk

- Applying restrictions to the credit agreement

- Diversifying

- Credit insurance and derivatives

- Knowing when to end a business relationship

Module 4: Factoring and Invoice Discounting

- What is factoring?

- The key parties involved in factoring

- The factoring process

- Characteristics of factoring

- What is invoice discounting?

- The differences between factoring and invoice discounting

- Different types of factoring and invoice discounting

- Using factoring as a means to reduce risk

- Using invoice discounting as a means to reduce risk

- Disadvantages of factoring

- Charges and payments associated with factoring

Module 5: Negotiating with creditors

- Determining the debtor’s position

- Using a flexible, fair and realistic approach to collection

- Options available to a customer who has debts

- Tackling secondary debts

- Loan consolidation

- Debt Management Company

- An Administration Order

- Individual Voluntary Arrangement (IVA)

- Starting the collection process

- Negotiating a payment plan

- Recording details of the payment agreement

- Further debt recovery actions

- Skills required when negotiating and collecting debts

Module 6: Business management

- The manager’s role- Personal skills

- Setting objectives

- Planning

- Decision making

- Delegating

- Motivating

- Organising

- Time management

- Managing People

- Recruitment

- Reviewing progress

- Development

- Team working

- Building an effective credit control team

- Managing Information

- Collecting information

- Organising information

- Communicating information

- Managing Finance

- Cost analysis and control

- Financial information

- The balance sheet

- The profit and loss account

- The cash flow statement

- Budgeting

(Please click on the curriculum tab above to see a detailed view of each module)

What Will You Learn?

- The Credit Control and Risk Management delves into sophisticated financial practices, covering advanced credit control techniques, risk assessment methodologies, and financial decision-making strategies.

- Learners explore the intricacies of credit management, examining the principles behind effective credit policies and procedures.

- This includes in-depth insights into assessing creditworthiness, managing credit risk, and analysing financial statements to make informed credit decisions.

- It equips participants with the skills to develop and implement robust risk management frameworks, ensuring effective financial planning and sustainable business practices.

Who is this course for?

- The Credit Control and Risk Management caters to finance professionals, credit controllers, risk analysts, and individuals working in financial management.

- It's designed for those seeking advanced expertise in credit management, risk assessment, and financial decision-making.

- Additionally, business owners, entrepreneurs, and managers aiming to enhance their financial understanding and mitigate financial risks within their organisations will find this course beneficial.

- This program is also suitable for individuals aspiring to pursue careers in financial consultancy or those involved in assessing creditworthiness and managing financial risks across diverse industries.

Requirements

At Open Learning College, we firmly believe that education should be accessible to everyone, regardless of their background or previous education experience. That’s why we’ve designed our Credit Control and Risk Management (Level 4)course to be open to anyone who is interested in learning more about this fascinating subject, without any prior knowledge or experience required.

Career path

Financial risk analysts are commercially aware communicators who can spot the potential risks to a project or business

As a financial risk analyst, you’ll identify and analyse areas of potential risk threatening the assets, earning capacity or success of organisations in the industrial, commercial or public sector.

Questions and answers

Certificates

QLS & OPA

Digital certificate - Included

Open Learning College have undergone external quality checks to ensure that the organisation and the courses’ it offers meet a high standard. Regular reviews of our courses are carried out as part of the endorsement process.

The course depth and study has been benchmarked at Level 3 against level descriptors published by Ofqual.

Visit www.qualitylicencescheme.co.uk for more information.

1. You will receive your accreditation directly from QLS, once you have successfully completed your course (certification fees are included in the course fee).

2. You will receive the Open Pathway Accreditation Diploma (OPA.dip) from Open Learning College.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.